Latest news

Carbon tax is one of the most cost-effective means of reducing carbon emissions, thus highly advocated by researchers and policymakers]. Evidence suggests that carbon tax could impose negative impacts on CO2 emissions, which is mainly obtained from the experiments conducted in North European countries such as Denmark, Finland, and Sweden, the first group of adopters of carbon tax. Besides the direct environmental benefits, carbon tax can also promote low-carbon transition by encouraging clean technological innovation, and reducing ‘brown’ financing (e.g., financing to polluted projects) .

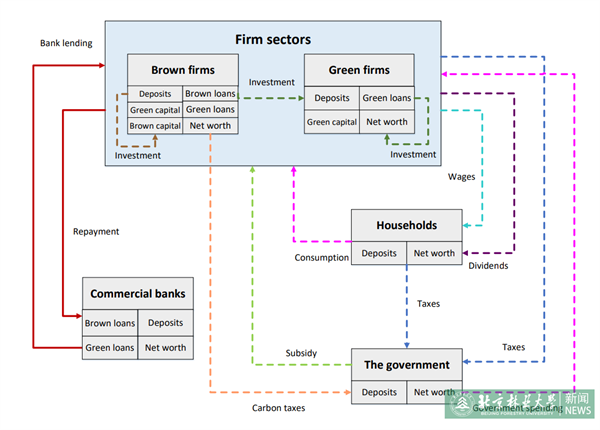

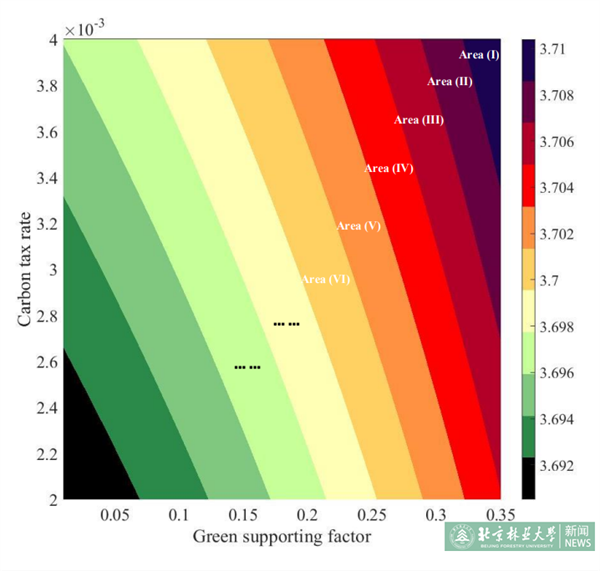

Climate policies such as carbon tax and green finance policy are critical measures to promote low-carbon transition worldwide. These policies are, however, likely to interact with each other and create unintentional consequences. This paper adopts a stock-flow consistent model to theoretically explore the effects of policy interactions. Specifically, commercial banks, as the key credit creators and critical players in providing source of finance, are included. Based on the numerical simulations of the dynamic model, we find that both carbon tax and green finance policies render positive impacts on low-carbon transition. In addition, green credit incentives, if imposed simultaneously with carbon tax, can enhance the positive effects. Although low-carbon transition could generate higher net government revenues, our results show that banking sector tends to expose to higher financial risks when firms’ debt-equity ratio rises. Further analysis shows that subsidies on green loans can support green transition and bring positive consequences to debt rollover and social welfare, indicating the needs for active government intervention to improve policy effectiveness. The framework proposed in this paper provides a useful way to understand policy dilemmas in pursuing low-carbon transition and give important implications to form optimal policy mix.

This study is another important achievement made by the School of Economics and Management of BFU in serving ecological civilization construction. Xing Xiaoyun is the first author of the paper; Professor Zhang Dayong, Institute of Economics and Management, Southwest University of Finance and Economics, is the corresponding author; Guo Kun, Associate researcher, School of Economics and Management, University of Chinese Academy of Sciences, and Ji Qiang, Researcher from the Institute of Strategic Consulting of Science and Technology, Chinese Academy of Sciences, are the co-authors. Beijing Forestry University is the signature unit of the first author.

This research is supported by the National Social Science Foundation of China (NSSFC) Major project Grant No. 20&ZD110; the National Natural Science Foundation of China Grant No. 71974159, 72348003, 72022020, 71974181, and the 111 Project Grant No. B16040.

Paper link: https://www.sciencedirect.com/science/article/pii/S0306261924000473